Kathmandu: Nepal’s Central Bank has cautiously introduced the monetary policy for the upcoming fiscal year with a flexible directive.

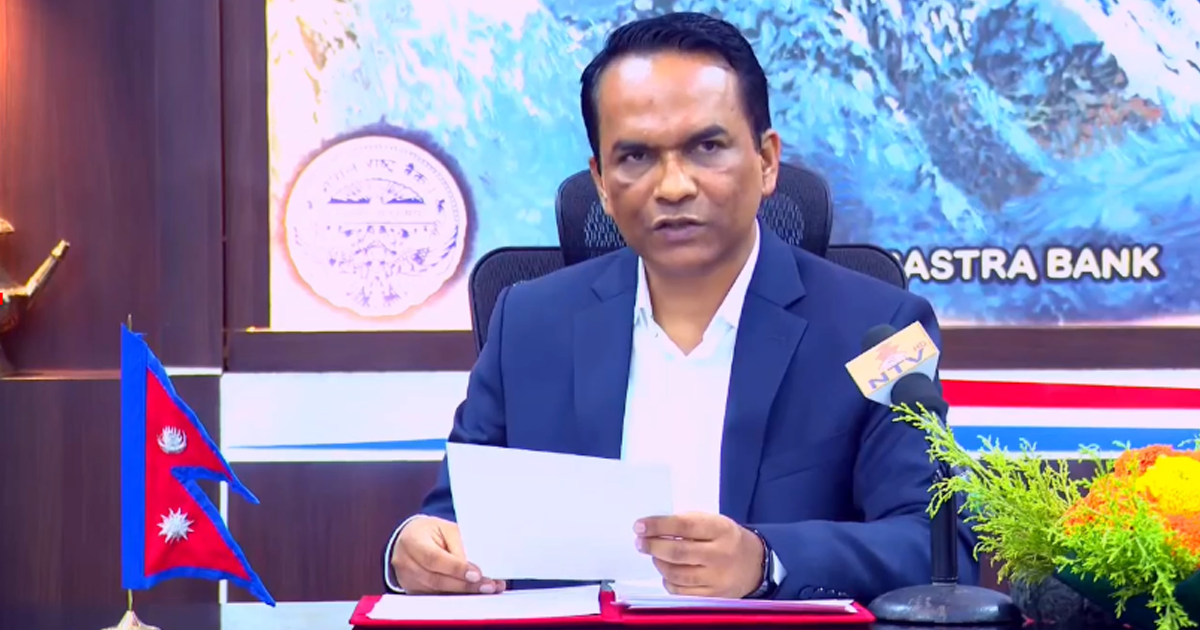

Unveiling the policy on Friday, Governor Dr. Bishwanath Paudel stated that the monetary policy has been designed with careful attention to stimulate overall demand and prevent deposit interest rates from turning negative.

In his first monetary policy presentation, Governor Paudel said the key targets are aligned with the government’s economic growth goal of 6 percent. The policy aims to maintain foreign exchange reserves sufficient to cover imports of goods and services for seven months and to keep inflation at 5 percent. He added that monetary liquidity and foreign exchange policies will be managed accordingly.

To support the government’s growth target, the monetary policy projects a 13 percent expansion in broad money supply and a 12 percent increase in private sector credit.

The policy keeps the mandatory cash reserve ratio and statutory liquidity ratio unchanged. However, it reduces the bank rate, which serves as the upper limit of the interest rate corridor, from 6.5 percent to 6 percent, and the policy rate from 5 percent to 4.5 percent.

Similarly, the deposit collection rate has been lowered from 3 percent to 2.75 percent. Governor Paudel also announced that the Nepal Rastra Bank will issue bonds as needed to manage liquidity.

Comment Here