Kathmandu: In a sweeping move to curb market manipulation and ensure financial discipline, the Securities Board of Nepal (SEBON) is preparing to enforce a new rule requiring investors to deposit the full estimated amount for share purchases in broker accounts before placing buy orders.

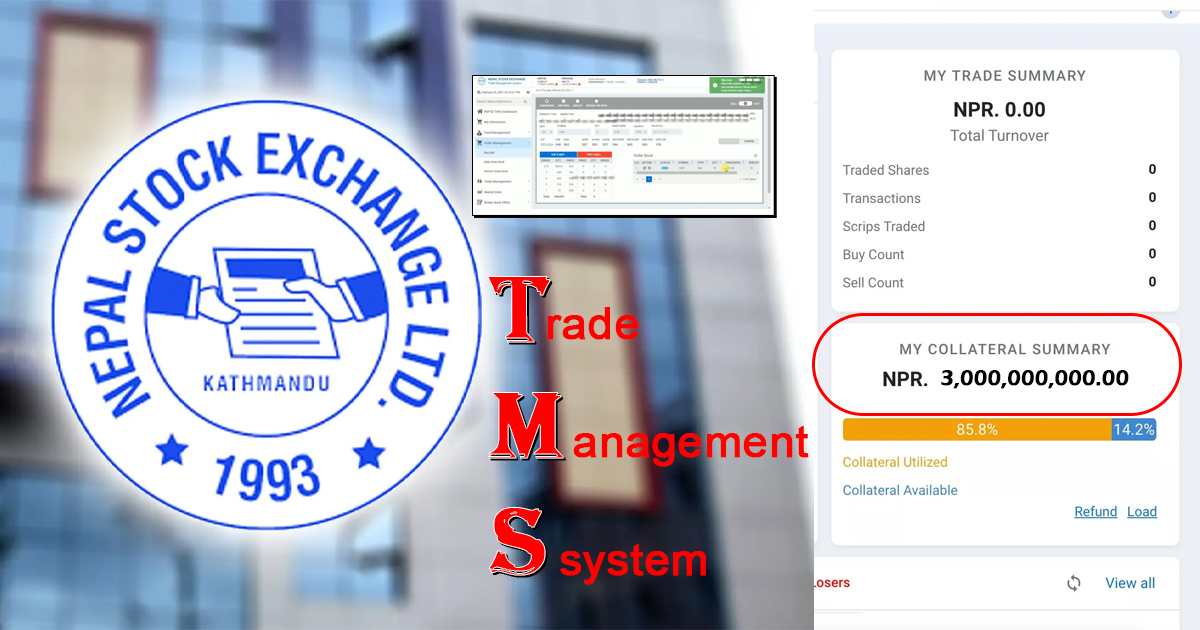

Under the current system, investors have been allowed to place purchase orders with just 25 percent of the estimated transaction amount as collateral, either deposited in the broker’s account or secured through a cheque.

Brokers would then grant up to four times the deposited amount as a trading limit. This system, however, has reportedly been exploited by influential investors and brokers to manipulate stock prices.

The proposed revision—part of an amendment to the Securities Transaction Regulations—will eliminate the existing 4x leverage and the use of cheques as collateral. Instead, investors will be allowed to buy only as many shares as they have fully funded in cash, deposited directly into the broker’s account.

Ministry orders 100 percent collateral enforcement

This change follows a directive from the Ministry of Finance issued on 23 June 23, which instructed SEBON to mandate 100 percent collateralization of share transactions. The ministry also reportedly issued verbal instructions to ensure that the funds must be credited to the broker’s account before showing up as collateral.

A ministry source said, “We found that some powerful investors, in collusion with brokers, were misleading ordinary investors by showing fake buy orders to artificially inflate stock prices. Once the price rose, they would offload their holdings, trapping unaware retail investors. To stop such malpractice, we have instructed SEBON to ensure full cash-backed collateral before any transaction.”

Crackdown on collusion and artificial demand

SEBON officials revealed that some investors, using their connections, had been issuing cheques without sufficient bank balances to gain large trading limits. These cheques, despite not being cashable, were used to artificially raise collateral limits, especially in stocks with low supply, thereby creating false demand.

One SEBON source noted, “We discovered investors who submitted cheques worth up to Rs 800 million to brokers, but whose accounts held barely Rs 10-20 million. Based on these cheques, brokers were granting trading limits of up to Rs 3.2 billion—without actual liquidity. This not only created abnormal buying pressure but also distorted market dynamics.”

Such practices have led to a surge in complaints from brokers who were unable to recover dues from investors after market downturns, as well as from general investors who got caught in manipulated price cycles.

Market manipulation under watch

SEBON has begun strict monitoring of unusual purchase orders and has also corresponded with Nepal Rastra Bank to verify the liquidity behind suspect cheques. One investigation revealed that a cheque issued for Rs 800 million was backed by an account holding merely Rs 1.5 million. The board believes this is just the tip of the iceberg, indicating a widespread pattern of abuse.

An official from the board confirmed, “This is a representative case. We’ve found several such instances where cheques with no backing were used to manipulate collateral limits and distort the market.”

New measures in the pipeline

SEBON is now working to eliminate these loopholes completely. The revised regulations will enforce mandatory full payment before trade orders. No trade order can be placed unless the full estimated amount is already in the broker’s account.

There will be no more cheque-based collateral. Only actual cash deposits will be recognized. Zero leverage system means that the 4x trading limit currently in place will be scrapped entirely.

Tight coordination with banks will be made to verify funds and ensure cheque authenticity.

These changes will be implemented by amending the Securities Transactions Regulations 2018. The current law requires 25 percent upfront collateral for any purchase order. However, influential traders have long bypassed this using cheques with insufficient backing, something the new rules aim to end.

SEBON officials also said that they are exploring additional mechanisms to tighten compliance and introduce penalties for brokers who allow trades without verifying actual payments.

Comment Here