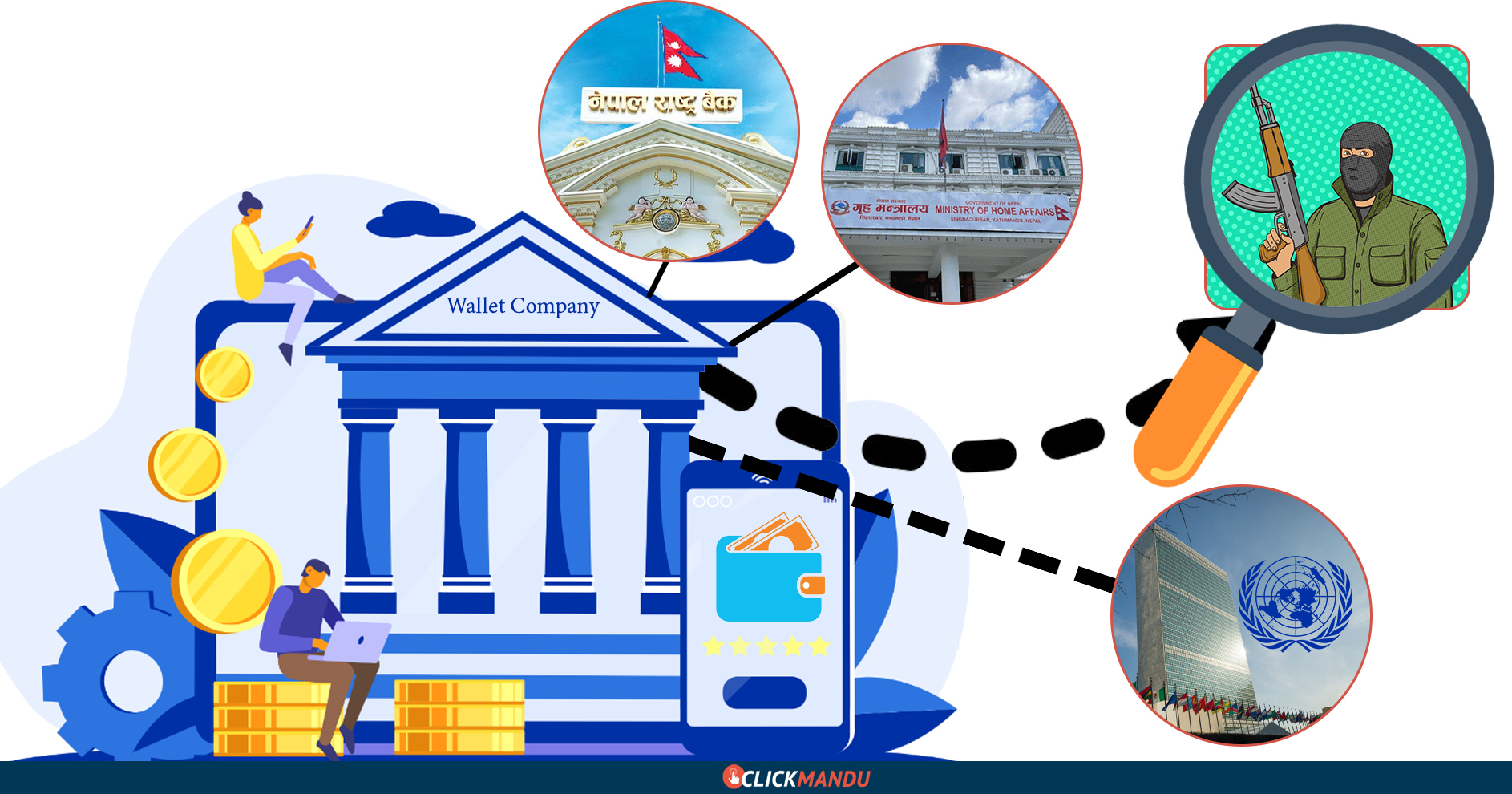

Kathmandu: Nepal Rastra Bank (NRB) has issued new guidelines requiring digital payment service providers (wallet companies) to identify individuals subject to targeted financial sanctions and freeze their accounts within 24 hours.

The move comes after Nepal was placed on the Financial Action Task Force’s (FATF) “grey list” earlier this year due to weaknesses in investigation and prosecution related to illicit funds.

Under the new directive, wallet companies must check both the United Nations consolidated sanctions list and Nepal’s own terrorism list published by the Ministry of Home Affairs. Transactions involving individuals or entities on these lists must be immediately suspended, and all related funds frozen.

Previously, NRB had assigned similar responsibilities to banks, financial institutions, the Employees Provident Fund, Citizen Investment Trust, Social Security Fund, and hire-purchase companies. Now, wallet providers are formally included as “reporting entities” under Nepal’s Anti-Money Laundering Act 2008.

The FATF’s latest report, published in December, noted that Nepal lacked a clear mechanism to freeze and unfreeze assets of individuals listed for terrorism-related activities by the UN within the required 24-hour window. Despite this, accounts under Nepal’s own domestic list were not being consistently frozen.

Key Requirements for Wallet Companies under the New Guidelines: i) Subscribe to UN sanctions list updates and enable notifications, ii) Regularly check the Ministry of Home Affairs’ targeted financial sanctions portal for updated names, iii) Conduct daily and continuous transaction screening against UN and government sanctions lists, iv) Match customer data, including beneficial owners, representatives, and related parties, with the lists, v) Freeze funds and block all transactions for confirmed matches, including individuals with matching names, aliases, birthdates, nationalities, ID or passport numbers, and addresses; or for legal entities with matching registration details, and vi) Report all frozen accounts or prohibited transactions to NRB within 3 days, followed by notifications to the Department of Money Laundering Investigation and the Department of Revenue Investigation.

NRB has warned that failure to comply could result in penalties ranging from formal warnings to revocation of operating licenses for wallet companies.

Comment Here