Kathmandu: When Biswas Dhakal, the founder, began stepping down from the executive chairmanship of F1Soft, the company he established, many wondered: Why was he leaving the executive responsibility of the company he built through his own struggles and expanded into a digital payment empire? What would he do now?

Banker Siddhanta Raj Thakuri was handed the executive role at F1Soft, with Dhakal remaining only as the Group Chairman. It was stated that the responsibility of running the company was given to professionals with the objective of establishing F1Soft as one of the world’s top 10 fintech companies within 5 years.

Biswas wanted to go beyond the country’s geographical boundaries and soar globally in the world of fintech. Therefore, he transformed F1Soft into F1Soft International and set out to expand his fintech empire from abroad.

Indeed, in recent years, Biswas Dhakal was rarely in Nepal. He had mostly started living in Dubai. Dubai, with its favourable business environment, has been attracting companies related to information technology. Biswas became the CEO of The Pips Company in Dubai.

The Pips Company, led by Biswas, a titan of the Nepali fintech industry, is now set to provide digital lending (loan) services in Bangladesh. The UAE’s global fintech company, The Pips, will assist AB Bank in expanding its digital banking capabilities through a strategic partnership.

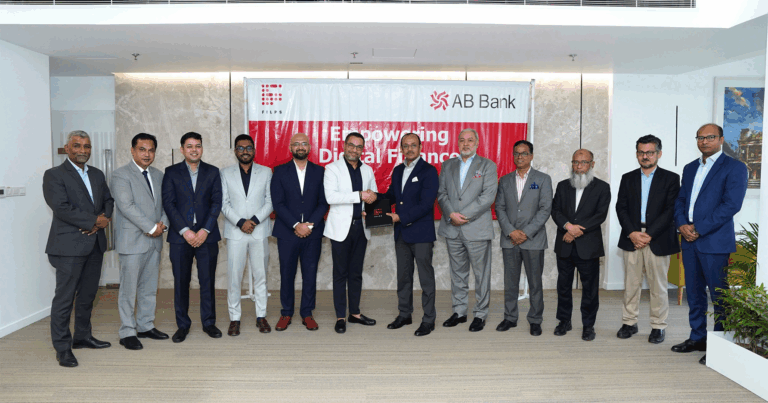

Bangladesh’s AB Bank has described this cooperation with The Pips as a remarkable step. The strategic partnership was recently signed by AB’s Managing Director and CEO, Syed Mizanur Rahman, and The Pips’ CEO, Dhakal. Also present at the signing ceremony were the company’s Chief Cooperation Officer Rishikesh Nepal, Chief Human Resources Officer Abhishek Kshetri, and the company’s Country Manager for Bangladesh, Tushar Hasan. This partnership with The Pips has opened a way for the bank to provide digital loans to its customers.

The Pips Company, led by Biswas, a titan of the Nepali fintech industry, is now set to provide digital lending (loan) services in Bangladesh.

In Nepal, banks provide loans through digital means in cooperation with Fonepay, known as “FoneLoan.” The Pips will similarly assist AB Bank in providing such services in Bangladesh.

“We are here with a commitment to accelerate digital transformation and deliver consumer-targeted innovation in collaboration with Bangladeshi banks, regulators, and industry stakeholders,” said a representative.

The Pips, established in the UAE in 2022, operates as an online platform providing software solutions to banks. Following the cooperation with AB, Dhakal stated they would provide an AI-powered micro-lending solution. He said this partnership would provide millions of Bangladeshis with fast, smart, and inclusive lending solutions.

Similarly, just a week ago, The Pips organized a “Bankers Meet” in Dhaka, Bangladesh. The company held an evening discussion exploring the future of Bangladesh’s digital banking domain. The Bankers Meet saw the participation of CEOs and senior officials from banks.

On that occasion, The Pips showcased its digital loan technology and solutions for engaging customers in the digital system. The company demonstrated the potential for customer-centric transformation in Bangladesh.

During the event, The Pips also announced a partnership with City Bank alongside AB. The company stated that the cooperation with City would involve a complete overhaul of the bank’s digital banking platform, “City Touch,” to provide a seamless, simple, and user-friendly experience.

During the Bankers Meet, Dhakal announced that The Pips would bring a blend of proven technology and deep operational expertise to emerging economies like Bangladesh.

“We are here with a commitment to accelerate digital transformation and deliver consumer-targeted innovation in collaboration with Bangladeshi banks, regulators, and industry stakeholders,” he said.

F1Soft: A company giving 200 percent dividend

Established in 2004, F1Soft is an established company in Nepal’s fintech industry. Over 45 banks and financial institutions currently use the mobile and internet banking software developed by the company. F1Soft has also been providing services like digital top-up and bulk SMS, among others. In FY 2023/24, F1Soft generated a revenue of Rs 12.84 billion, while in FY 2022/23, its revenue was Rs 15.64 billion.

The reason for this decline in F1Soft’s revenue is its divestment from eSewa. F1Soft had 100 percent ownership of eSewa, out of which the company has divested 80 percent of its stake.

eSewa is F1Soft’s most profitable subsidiary. F1Soft sold its 80 percent stake in eSewa to its own shareholders. The shares in eSewa were sold in such a way that each shareholder’s proportional ownership in eSewa matched their ownership in F1Soft.

Furthermore, F1Soft recently launched Nepal Mobility Solutions (a ride-sharing app called JumJum). Divesting from eSewa, its highest profit generator, on one hand, and increasing investment in JumJum on the other, has led to decreased company revenue.

However, F1Soft has distributed dividends higher than expected in the last two years. It distributed a 200 percent dividend on its paid-up capital in 2022 and a 100 percent dividend in 2023.

Similar to eSewa, the ownership of F1Soft is also held by Biswas Dhakal (35 percent), Asgar Ali (25 percent), Sambhav Sirohiya, MD of Kantipur Media Group (20 percent), Suvas Sharma (10 percent), Subhas Sapkota (5 percent), and others.

The F1Soft Group includes eSewa, eSewa Money Transfer, Fonepay, FoneLoan, PhoneNXT, Cogent Health, FonePoints, Dialo Technology, FoneInsurance, Actenso Data, Logica Beans, Swastik College, JumJum, and eSewa Travel & Tour. Through Fonepay, F1Soft has reached 20 million individuals.

If the government provides a facilitative environment, Nepali businesspeople can spread across the world to demonstrate their skills and capabilities.

Having successfully established an empire in Nepal’s fintech industry through F1Soft, Biswas Dhakal has embarked on a global journey, expanding his ideas to Bangladesh through his Dubai-based company. This clearly indicates that if the government provides a facilitative environment, Nepali businesspeople can spread across the world to demonstrate their skills and capabilities.

How Dhakal started F1Soft

Around 22 years ago, Biswas Dhakal was studying Software Engineering at the Nepal College of Information Technology (NCIT). Amid various ups and downs, while continuing his studies at NCIT, Dhakal worked a data entry job at Plan International to cover his education costs. His salary was Rs 14,000 per month.

At that time, his friends were registering their own domains. Some were in the business of domain registration. A wave of domain registration was trending.

Dhakal, studying IT, thought he could start a business registering domains and web hosting. He thought that even if the income wasn’t substantial, it would at least cover his college fees.

He decided to register a company to do domain registration work. He registered F1Soft Company in 2004. He had worked at Plan International for three months and invested the little money he had saved into the company.

He worked in domain registration for almost one and a half years. In that period, he had registered 4,000 domains. The income from this allowed him to expand his office. With that income, he bought four computers and hired four staff.

F1Soft, which started with domain registration by Dhakal, has successfully become Nepal’s largest fintech company today.

It has now become a ‘Group of Companies’. Under it, more than a dozen companies are in operation.

It has been working through these companies in various fields such as banking, software development, health, insurance, bus tickets, money transfer, food & beverage, travel, and IT colleges. This has directly created employment for over a 1,000 people.

Digital payment revolution

F1Soft, established in 2004, began focusing on banking and finance from 2006 onwards.

It laid the foundation for digital payment in Nepal. On one hand, it worked to make the banking system easier and more digital, while on the other, it started digital payment services through eSewa.

When eSewa was launched in 2009, people did not trust them. Biswas’s team, which was trying to create ‘digital recharge’ for mobile top-up cards, had seen a big dream.

They knew the market was huge. Services like Paypal were aggressively entering India.

They worked with special focus on eSewa. Dhakal wanted to build a special team to work in this company. He felt he couldn’t work alone.

F1Soft, which started with domain registration by Dhakal, has successfully become Nepal’s largest fintech company today.

Subash Sharma and Asgar Ali joined him. Both were close friends from college.

After that, this team also started working in the banking sector. SMS Banking had started from 2008, letting customers know they could get bank information on their mobile too. This was refined further with the start of Internet Banking. Later, F1Soft also worked on Mobile Banking. It also started providing software to banks.

In 2012, eSewa was registered as a separate company and began operations.

Fonepay has been a major pillar in F1Soft’s journey. It has been creating an ecosystem for the company’s products, connecting one bank to another, mobile wallets, and banks.

And, having successfully established an empire in Nepal’s fintech industry through F1Soft, Biswas Dhakal has embarked on a global journey, expanding his ideas to Bangladesh through his Dubai-based company. This clearly indicates that if the government provides a facilitative environment, Nepali businesspeople can spread across the world to demonstrate their skills and capabilities.

Comment Here