Kathmandu: In a major step to address widespread corruption in the banking industry, Nepal Rastra Bank (NRB), the country’s central bank, has announced a zero-tolerance policy on bribery and corruption. The move comes after mounting complaints about irregularities in loan disbursements, collateral auctions, and promotional expenditures.

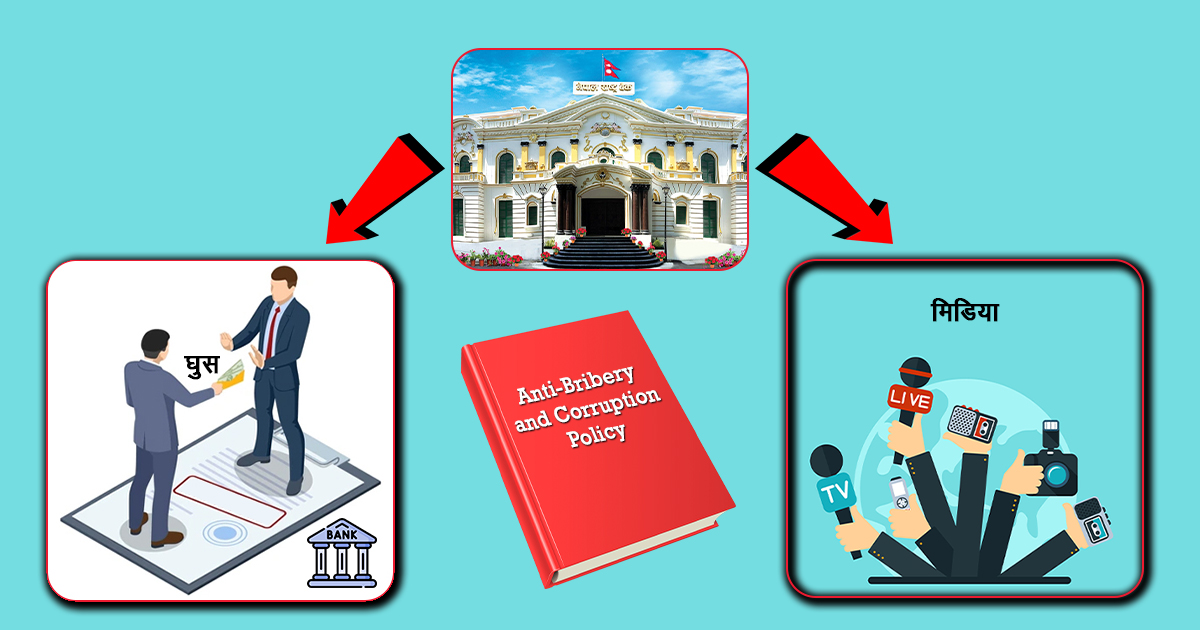

The central bank has decided to introduce a formal “Anti-Bribery and Corruption Policy” for all banks and financial institutions, as outlined in the first quarterly review of the current fiscal year’s monetary policy for 2025/26. The policy aims to strengthen transparency, accountability, and good governance in the sector, drawing on international best practices and local realities.

Governor Dr Biswa Nath Poudel has publicly highlighted irregularities in collateral auctions, describing them as part of systemic corruption. He pointed out that banks, as trustees of depositors’ funds, should prioritize depositor safety above all else. However, he noted that some auction processes are being manipulated, with assets sold at undervalued prices to benefit insiders.

Governor Poudel has received numerous complaints that branch managers and even CEOs are involved in irregularities, such as deliberately undervaluing collateral to favour certain buyers or colluding to block sales. He described these actions as unacceptable and stressed that bankers’ primary role is to manage banking operations, not to engage in real estate dealings or personal profiteering.

The governor also raised concerns about middlemen and brokers operating in loan disbursement, particularly in Madhesh Province, where complaints have surfaced about intermediaries demanding commissions to facilitate loans. In some cases, even board chairpersons of banks have been accused of taking bribes to arrange loans, leading to investigations by anti-corruption authorities.

NRB officials have pointed to other irregularities, including excessive spending on advertising and promotions—where one bank spends Rs 40 million while another spends only Rs 4 million in a year—without clear justification. Some banks have been found using large loans taken in the name of media outlets to purchase real estate or shares, diverting funds for personal gain. The central bank is now closely monitoring such transactions and plans to set stricter guidelines on permissible promotional expenses.

The new policy will also tackle issues such as misuse of authority by board members and management, improper loan classification, and the deliberate re-categorization of bad loans as performing through name changes or additional financing. Complaints have been rising about small businesses and farmers facing delays or needing intermediaries to access agricultural and small-business loans.

To curb irregularities in collateral auctions, NRB recently issued a circular requiring banks to publish three public notices before allowing non-banking entities to book auctioned assets.

Governor Poudel emphasized that reducing direct contact between service providers and customers through digital banking will significantly lower corruption risks. He also stressed that media outlets must maintain ethical standards, warning that misuse of loans taken in the name of journalism will be strictly scrutinized.

The central bank believes the Anti-Bribery and Corruption Policy will not only improve governance in the financial sector but also support Nepal’s efforts to exit the international “grey list” by demonstrating stronger anti-corruption measures. Officials noted that several private banks have already adopted similar policies internally.

NRB’s regulation and supervision departments are now reviewing banks’ spending patterns and loan practices in detail to ensure that all activities align with the principles of transparency and accountability.

Comment Here