Kathmandu: Senior management at Siddhartha Premier Insurance, including its chief executive officer, has been accused by employees of threatening staff to either resign or quietly accept discrimination in the workplace.

The allegations have surfaced after Premier Insurance and Siddhartha Insurance merged on an equal footing to form Siddhartha Premier Insurance, with employees from the former Premier Insurance claiming they have been subjected to systematic and ongoing discrimination ever since.

According to employees who spoke to Clickmandu, staff who came from Premier Insurance have faced unequal treatment in pay, benefits, medical coverage, retirement provisions and social security arrangements. When they raised these issues with management, they say the CEO did not try to resolve their concerns but instead applied mental pressure, telling them bluntly to “work if you want, otherwise leave.” After that, employees say, fear took over and no one dared to speak openly about discrimination.

The situation has intensified in recent weeks, with the company pressuring all staff to sign a so-called “consent form” linked to the 2024 Employee Service Regulations. Employees allege they are being told that if they do not sign, their grade will be frozen, promotions will be blocked and they could even be transferred. “We are being forced to sign a form saying we agree to everything, under threat,” one employee said. “If we don’t sign, we are told our career here will effectively end.”

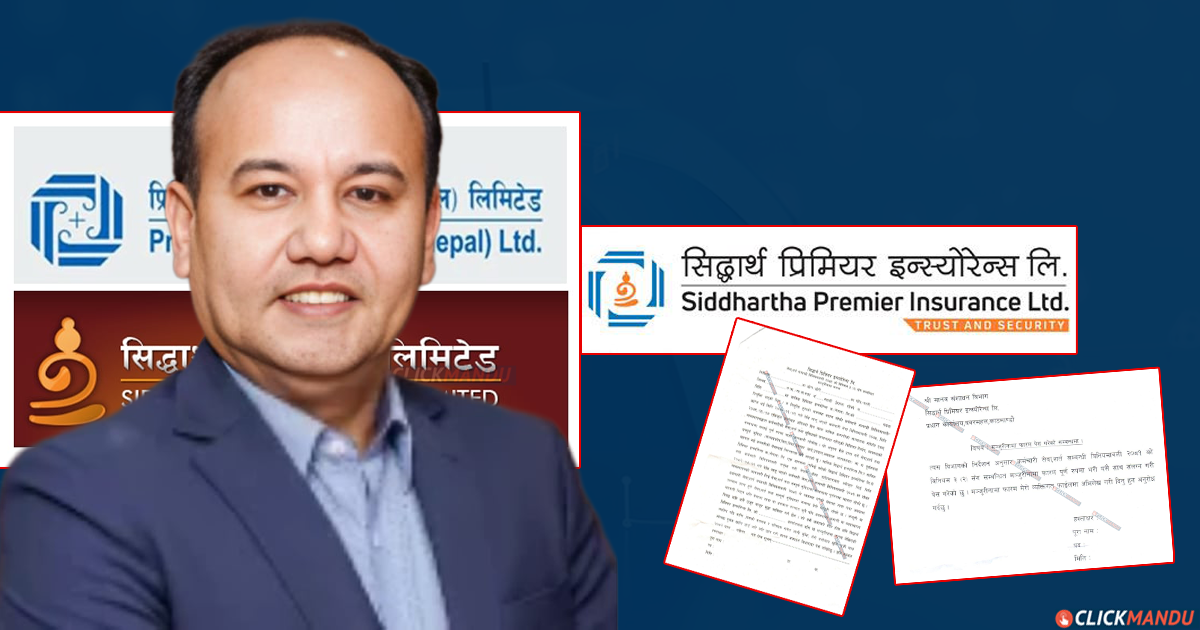

Employees claim that after the merger, Siddhartha’s former executives came to dominate the top management of the new company. The CEO, Birendra Baidwar, is himself the former CEO of Siddhartha Insurance, and most senior positions are now held by people from the Siddhartha side. Staff from Premier Insurance say this power imbalance has translated into discriminatory policies that favour Siddhartha’s former employees in core areas such as gratuity, medical benefits, post-retirement perks and social security.

One long-serving employee described how the merger stripped away benefits that Premier Insurance staff had enjoyed for years. Medical insurance that once existed was first folded into gross salary and then removed entirely after objections were raised. At the same time, benefits for former Siddhartha employees were expanded rather than cut. “We do the same work in the same company, yet there are two sets of benefits,” the employee said. “That is neither fair nor consistent with the spirit of a merger.”

Former employees of the company have echoed these claims, saying discrimination began almost immediately after the merger, especially in matters related to gratuity and social security. Although both sides were told that a single, unified set of service conditions would apply after the merger, in practice Siddhartha’s staff were given priority while Premier’s staff were sidelined.

The controversy has deepened because of the consent form the company is now pushing employees to sign. The form requires staff to declare that they fully accept all current service conditions, including salary, provident fund, leave, insurance, medical expenses, gratuity and retirement benefits, and that they will never file any complaint or legal case against the company now or in the future.

It even states that if an employee does take legal action, the signed form should automatically invalidate it. Employees say they are being asked to sign this document under duress, with management citing board directives and sending repeated emails demanding compliance.

Many staff believe the real reason for the form is fear of legal challenges. One employee who had worked for more than two decades at the company took the firm to Labour Office after the merger when promised benefits were withheld. The court ruled in his favour, confirming that a merger cannot be used as an excuse to cut benefits guaranteed in appointment letters and company regulations. Employees now believe the company is trying to prevent similar lawsuits by forcing everyone to waive their rights in advance.

The financial and benefit disparities between the two groups of employees are at the heart of the dispute. Under the new rules effective from mid-November, former Siddhartha Insurance staff are entitled to gratuity of one month’s salary for up to 10 years of service, one and a half months for 11 to 15 years, and two months for more than 16 years.

Former Premier Insurance employees, however, receive just one month’s salary as gratuity regardless of how long they have worked. In retirement benefits, Siddhartha employees have their benefits calculated up to the age of 60 even though the official retirement age is 58, while Premier employees are capped strictly at 58.

For many employees, especially those who came from Premier Insurance, the promise of an equal merger now rings hollow.

There are also differences in social security arrangements. Before the merger, Premier Insurance staff were enrolled in Social Security Fund, while Siddhartha staff were part of the Employees’ Provident Fund. Three years after the merger, the company still runs two parallel systems. Premier employees say they are penalized for being in the Social Security Fund, receiving lower or no gratuity and reduced retirement benefits, while Siddhartha staff were even given the option of choosing which system they preferred.

The company has rejected all allegations of discrimination. Its information officer, Sudarshan Acharya, insists that no employee has been treated unfairly and that the current service regulations are simply a continuation of what was agreed during the merger. He says the company has not deviated “even by a comma” from the original merger terms and that claims of unequal treatment are unfounded.

Premier Insurance and Siddhartha Insurance officially began operating as Siddhartha Premier Insurance on 1 March 2023, after receiving approvals from Nepal Insurance Authority, the Securities Board and the Office of the Company Registrar. Both companies had roughly equal paid-up capital at the time of the merger, and the deal was done on a one-to-one basis.

Yet for many employees, especially those who came from Premier Insurance, the promise of an equal merger now rings hollow. They say that instead of unity, the merger has created a two-tier workforce where one group enjoys better pay, stronger retirement security and greater protections, while the other is being pressured into silence.

With regulators yet to intervene, workers fear that unless the alleged discrimination is addressed, the merger will stand not as a model of consolidation but as a cautionary tale of how corporate power can override employee rights.

Comment Here