Kathmandu: Credit cards have become the single largest source of non-performing loans (NPLs) in Nepal’s banking system, surpassing all other loan products, according to data from Nepal Rastra Bank (NRB).

Central bank figures show that among various types of bank lending, credit cards now carry the highest proportion of bad loans.

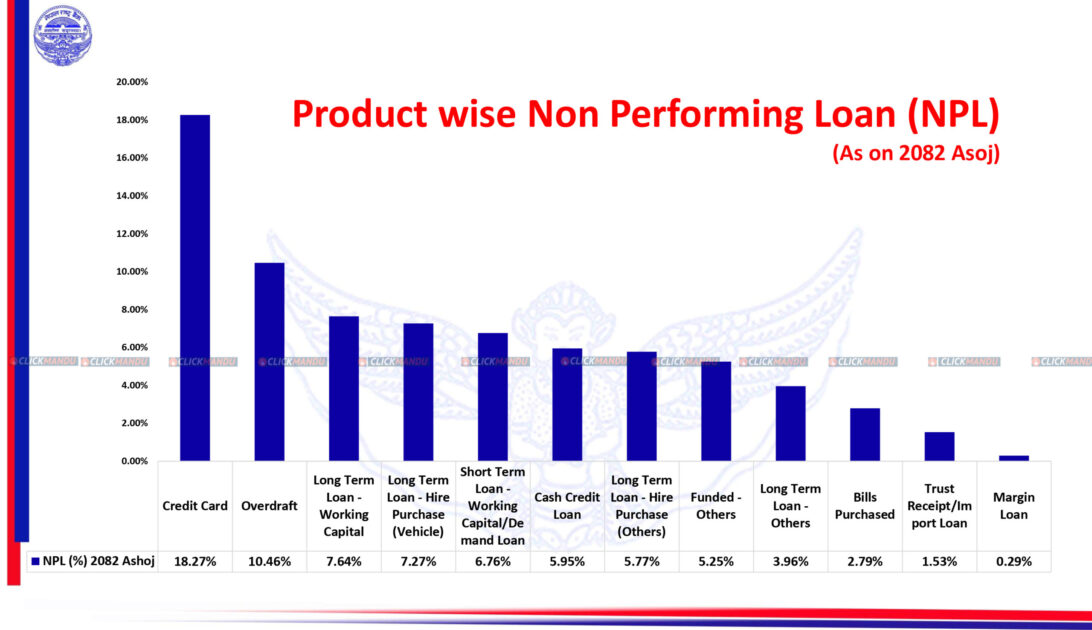

Data obtained by Clickmandu shows that as of mid-October 2025 (end of Ashwin 2082), the NPL ratio on credit cards had surged to 18.27 percent. This is significantly higher than the overall banking sector average and well above other lending categories.

Banks have often pointed to directed lending mandated by the central bank as a source of stress, but the data reveals that NPL levels are even higher in credit cards and overdraft facilities. By mid-October, overdraft loans recorded an NPL ratio of 10.46 percent, second only to credit cards. These overdrafts largely consist of unsecured, personal-type facilities where the specific purpose of borrowing is not clearly defined.

According to Sudesh Upadhyay, Deputy Chief Executive Officer of NMB Bank, the structure of credit card lending itself drives higher defaults. Interest charges often exceed the principal amount, causing arrears to escalate quickly. Credit cards typically carry a monthly interest rate of around 2.5 percent and are unsecured, making them inherently riskier. Because default levels are high, banks price credit cards at higher interest rates and rely on those earnings to write off bad loans, a standard banking practice. However, Nepal’s relatively small credit card user base has amplified the problem.

Credit cards in Nepal are mostly used by merchants and professionals. In recent years, many professionals have left their jobs and migrated abroad, sometimes knowingly and sometimes unknowingly leaving unpaid credit card balances. As interest compounds at 2.5 percent per month, outstanding dues balloon rapidly, pushing these loans into non-performing status. “The main reason credit card NPLs are so high is that interest exceeds principal,” Upadhyay said.

Clickmandu’s data shows that even banks with the lowest credit card NPL ratios still record figures above 10 percent, while some banks have seen credit card NPLs exceed 25 percent.

Overdraft loans show a similar trend. Although overdrafts account for only 3.4 percent of total bank lending, they make up 6.8 percent of total non-performing loans. As economic conditions have weakened, small and medium-sized businesses have increasingly relied on overdrafts to manage cash flow and repay existing debts. Bankers say that prolonged economic slowdown has driven up defaults in these facilities as well.

After credit cards and overdrafts, working capital loans carry the next highest level of stressed assets. Long-term working capital loans have an NPL ratio of 7.64 percent, well above the banking sector average. Overall, NRB data shows that the sector-wide NPL ratio reached 5.26 percent by mid-October.

Other loan categories also show elevated stress. Long-term hire purchase loans, mainly vehicle financing, have an NPL ratio of 7.27 percent, while short-term working capital loans stand at 6.76 percent. Cash credit loans, which banks increasingly use after NRB introduced working capital lending guidelines, have an NPL ratio of 5.95 percent. Long-term hire purchase loans under other categories stand at 5.77 percent. All of these exceed the sector’s average NPL level.

In contrast, some loan products remain relatively safe. Funded loans under other headings record an NPL ratio of 5.25 percent, long-term loans under other categories 3.96 percent, bills purchase loans 2.77 percent, trust receipt and import loans 1.53 percent, and margin lending just 0.29 percent, making share-backed loans the least risky for banks.

NRB data also shows that more than 60 percent of total non-performing loans fall under the “loss” category. By mid-October, 60.2 percent of NPLs were classified as loss loans, 22.5 percent as substandard, and 16.7 percent as doubtful. Although the share of loss loans has declined slightly from 62.9 percent in mid-July, it remains alarmingly high. Compared with mid-2024, when loss loans accounted for 55 percent of NPLs, the quality of stressed assets has continued to deteriorate, underscoring deepening risks within Nepal’s banking system.

Comment Here